When we invest in cryptocurrencies, we have to take into account that they are not regulated by a government like conventional currencies, and that their value is determined by supply and demand, which is generally very volatile.

Am I risking my money making a blind bet on a market I don’t know about? And, on the other hand, I’m missing an opportunity to invest at a stage where the market is down and consequently had high gains with the recovery of the market!

We can think of the cryptocurrency market as the birth of something new. When something is created, the early times always represent a lot of confusion, advances, and setbacks; up and down! By this, I mean that there is a lot of uncertainty, and that this uncertainty is part of the creation of something new! It must be looked at with caution and tranquility.

Taking this into account, the cryptocurrency market can be viewed in two different ways. Long-term investment or short-term investment.

Long-term investment is usually supported by investors who believe cryptocurrencies represent the future of money and support a decentralized financial system. As such, they invest to obtain returns after one or more years. These investments involve a careful analysis of the project of which the cryptocurrency in question is part, its usefulness, and the work team. It is important to realize that a long-term investment implies going through a lot of large fluctuations. To help with long-term investments, some portfolios allow for long-term staking of cryptocurrencies obtaining annual returns that can be higher than 100%.

On the other hand, short-term investment is supported by investors who want to take advantage of market volatility to make money. These investors bet on the technical analysis of the cryptocurrency taking advantage of price rises and falls to make money on a recurring basis through transactions.

You don’t have to decide on one or the other way to invest. You can allocate a portion of your long-term investment and a part in the short term. If you are at the beginning of your cryptocurrency journey, I advise you to study well the different currencies in the market and the most appropriate means to make your investments. As any investment, you must be prepared to lose! The only way to avoid losing money is to use the tools you feel comfortable with, and knowing well the trends and the cryptocurrencies projects you want to invest.

So what do I need to start my crypto investing journey?

Getting good profits depends on when you enter the market. The sooner you start, the higher the potential profit you can get.

There are many tools available to make your investments. My advice is to choose the ones that please you the most, and study and master them well, so that when you use them, it will feel natural, allowing you to devote all your attention to the cryptocurrencies you want to invest.

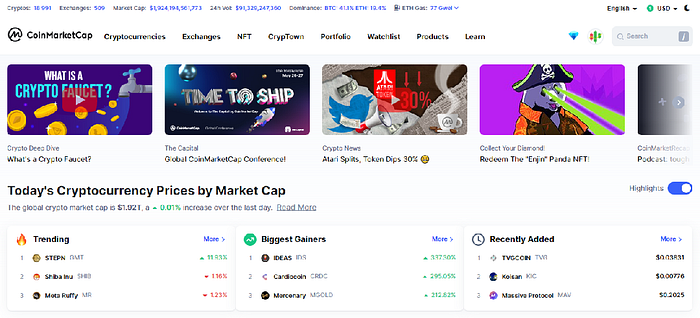

To understand investment trends, you need to use tools that allow you to analyze the fundamental and technical data of each cryptocurrency. To obtain this information, I use CoinMarketCap or CoinGecko. These sites give you all the information you need to know for a good analysis of the project, the team members, as well as technical data of cryptocurrency performance.

For a technical analysis and monitoring of the charts of each cryptocurrency in real time I use TradingView. You can use the website or the Trading View app to analyze the evolution of each cryptocurrency in real-time. TradingView provides indicators, metrics and strategies for an in-depth analysis allowing you to make investments in the very short term.

To analyze trends, I use two sites. Evaio presents a cryptocurrency rating based on performance and growth trend. Messari classifies cryptocurrencies and provides tools that allow you to obtain information for making decisions on buying and selling.

To follow the news about the different cryptocurrencies and market information, I use the Cryptopanic. This site aggregates news from various media and presents them in the form of topics.

Finally, the most important instrument, the wallet for your cryptocurrencies. I use three wallets to gain access to a wider variety of cryptocurrencies, and not to have my entire portfolio in the same wallet. The three Wallets I use for long- and short-term transactions are Coinbase, Crypto.com and Binance. These wallets have very similar systems to each other. I started with Coinbase, and just after a while I started using Crypto.com and Binance.

Crypto.com Stake rewards

Crypto.com Stake rewardsToday, the wallets I use the most are Crypto.com and Coinbase, which allow me to cover the currencies I deal with the most. In terms of long-term yield, I use Crypto.com and CakeDefi because they are the ones that allow me to get more profitability from the currencies I have in Staking.

For a weekly selection of cryptocurrencies (strongest cryptos, trending cryptos and new cryptos) follow me on YouTube or Twitter. In the next article, I will talk about how I make my investments, how I select cryptocurrencies, and how I distribute my portfolio. What I have invested in the short term, long term and staking.

The views and opinions expressed here are solely those of the author. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Some of the links here are affiliate links. This means that I may earn a commission at no additional cost if you click through and make a purchase. These commissions help me create free valuable information like these.

Social Plugin